The 50/30/20 Rule Explained: A Simple Path to Better Budgeting

Learn how the 50/30/20 rule divides your money into needs, wants, and savings so you can budget easier, pay debt faster, and save more.

A Simple Framework That Works

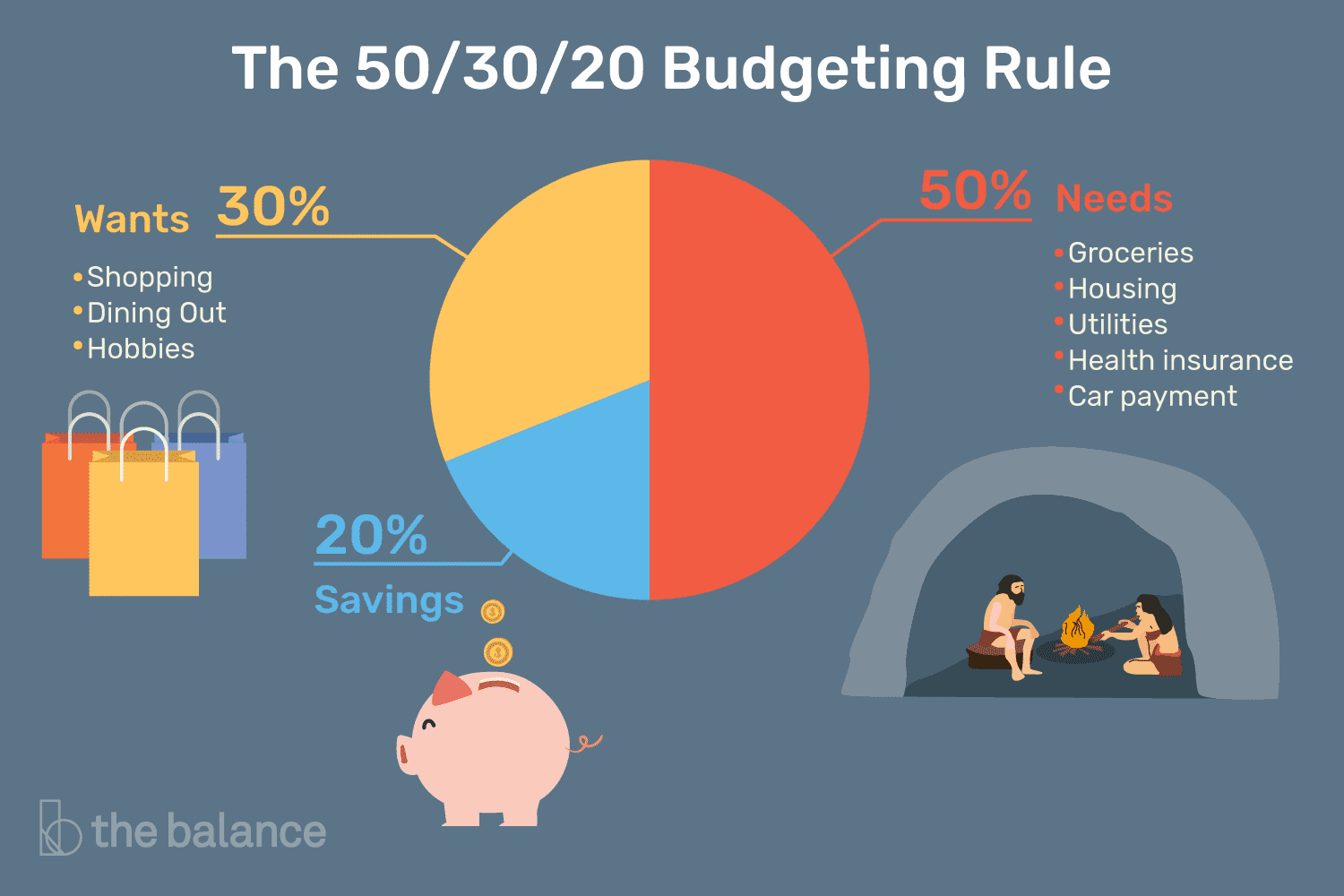

The 50/30/20 rule offers a clear roadmap for organizing your money without complicated spreadsheets. Start by calculating your after-tax income, then divide it into three buckets: 50 percent for needs, 30 percent for wants, and 20 percent for savings and debt. This structure acts like guardrails, helping you spend with purpose while still enjoying life. It is not about strict deprivation; it is about intentional choices and alignment with your values. By labeling every expense as a need, want, or savings or debt move, you gain instant visibility into where your cash actually goes. The percentage targets are flexible, yet they give you a benchmark to measure progress and spot pressure points. If your needs are crowding out savings, you will see it. If wants expand too much, you will catch it early. Over time, the simplicity compounds, reducing stress and freeing mental energy for goals that matter.

Defining Needs With Precision

In this framework, needs are your essential expenses that keep life stable: housing, utilities, basic groceries, transportation required for work, insurance, medical essentials, and minimum payments on debts. Precision matters, because it is easy to inflate this category with upgrades that feel vital in the moment. A functional phone is a need; the latest model is likely a want. Track your baseline cost of living by totaling rent or mortgage, average utilities, transit or fuel, and the recurring bills you must pay to keep commitments current. Aim to cap this area near half of income, understanding that some months will vary. If needs exceed the target, focus on fixed costs first, since big recurring savings compound. Consider negotiating service bills, reviewing insurance coverage, optimizing energy use, meal planning, and comparing providers. Even small reductions in rent, transportation, or insurance can unlock room for savings, building resilience against surprises without sacrificing essentials.

Spending on Wants With Intention

Wants are the discretionary spending that makes life richer: dining out, travel, entertainment, hobbies, fashion, home decor upgrades, and premium versions of things you already have. This category is not indulgence to eliminate; it is space to enjoy intentionally. Use a value per use test: items or experiences you will love repeatedly offer higher joy per dollar than impulse buys. Try a simple cooling off rule for larger purchases, and prune your subscription garden every few months. Plan seasonal fun funds so celebrations and getaways are funded on purpose, not on credit. When your wants budget is defined, splurges can be fully guilt free. Keep an eye on lifestyle creep, the quiet expansion that happens as income rises. Redirect a portion of every raise into savings first, then consciously choose which wants to elevate. This protects long term goals while keeping room for the moments that make memories.

Saving and Crushing Debt

The final bucket powers your future: savings and debt repayment. Start by building an emergency fund to cover several months of essential expenses, giving you breathing room when life throws a curveball. Next, prioritize high-interest debt using the avalanche method for maximum math efficiency or the snowball method for faster motivation wins. Layer in automation by setting transfers on payday to savings accounts and extra payments toward targeted debts, turning good intentions into systems. Use sinking funds for predictable big costs like insurance premiums, car maintenance, or holidays, so you never scramble at the last minute. If available, fund retirement accounts consistently, especially when there is any match on contributions. As debts shrink, roll freed-up payments into savings for momentum. Consistency beats perfection; even small automatic contributions grow into meaningful cushions. This category is where stability and opportunity are born, converting income into freedom, options, and calm.

Adapt It to Your Reality

The rule is a guide, not a rigid law. In high cost areas, needs can temporarily exceed half of income. Consider a temporary tilt: reduce wants, hold the savings target steady, and pursue gradual housing or transportation adjustments over time. For freelancers and anyone with irregular income, base your plan on a conservative average and build a rolling reserve that smooths slow months. Students or new grads might emphasize debt payoff, while families with childcare spikes may rebalance until expenses ease. Track your three categories as percentages, even if the exact mix shifts for a season. What matters is momentum toward a healthier split. Revisit your plan during major life changes, then set a date to reassess and normalize. Side income, negotiating bills, or downsizing one large expense can create rapid progress. The aim is flexibility with intention: adapt the framework to your context while keeping the spirit of balance and forward motion.

Make It Stick Every Month

Turn the rule into a routine with a simple playbook. First, total your after-tax income, then convert the three percentages into dollar caps for the month. Choose a tracking method you will actually use, whether a spreadsheet, a basic budgeting app, or digital envelopes that separate money by category. Set up automation on payday: transfers to savings, extra debt payments, and bill pay for essentials. Schedule a weekly money minute to glance at category totals, move small amounts if needed, and course correct before surprises grow. Mid month, trim low value wants to protect savings goals. Month end, review what worked, adjust targets, and celebrate any win, however small. Watch for common pitfalls: forgetting annual costs, mislabeling nice to haves as needs, and skipping minimums. As habits form, the process feels lighter. The 50/30/20 rule becomes less a budget and more a system that steadily moves you toward security and choice.