Personal Finance

12 posts in this category

How to Build an Emergency Fund That Actually Works

Build a real emergency fund with clear targets, the right account, and habits that stick so surprises don't become debt. Step-by-step plan inside.

From Paycheck to Purpose: Setting Financial Goals You'll Stick To

Turn every paycheck into progress. Set meaningful, measurable goals, build habits to sustain them, and align your money with the life you truly want.

Side Hustles That Scale: Turn Spare Time into Reliable Income

Build income that compounds instead of trading hours for dollars. Learn scalable side hustles, systems, and a 90‑day plan to start today.

Automate Your Money: Systems to Save, Invest, and Pay Bills on Autopilot

Build a money system that runs itself. Learn how to automate saving, investing, and bill pay so you hit goals on time—without constant effort.

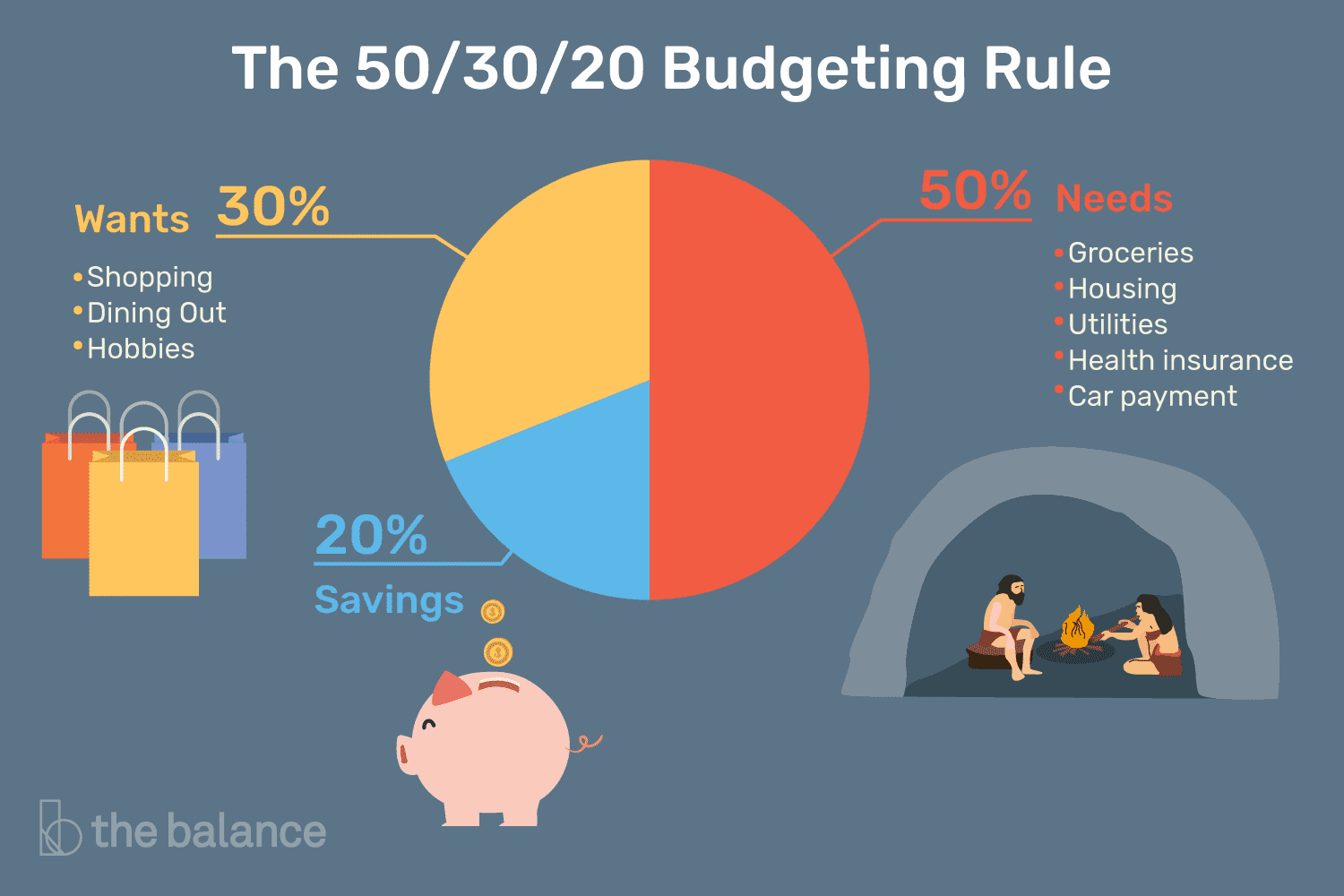

The 50/30/20 Rule Explained: A Simple Path to Better Budgeting

Learn how the 50/30/20 rule divides your money into needs, wants, and savings so you can budget easier, pay debt faster, and save more.

Frugal Without Feeling Deprived: Smart Ways to Cut Everyday Costs

Cut costs without cutting joy. Use mindful spending, smart swaps, and automation to save daily while still living well and hitting your goals.

Credit Scores Demystified: Factors That Matter and Habits That Help

Learn what truly drives your credit score—payment history, utilization, and more—and adopt simple, proven habits to build, protect, and sustain it.

Retirement Planning When You're Starting Late

Starting late? Catch up on retirement with priority budgeting, higher savings rates, smart tax moves, and a focused, lower-cost investment strategy.